Commodity

Seeks to enhance returns

while reducing porfolio risk

Fixed Income

Source of

regular income

Equity

Long Term

Wealth Creation

High volatility in commodity prices provides opportunity to make higher than normal returns

Potential for higher returns through commodity arbitrage

Factors affecting Equity or Debt returns do not affect commodity returns in a similar manner.

Margin for commodity derivatives in much lower than that for other asset classes

Commodities help hedge against inflation

Easy to buy and sell commodity derivatives

The pioneer of commodity investing

through mutual funds in India.

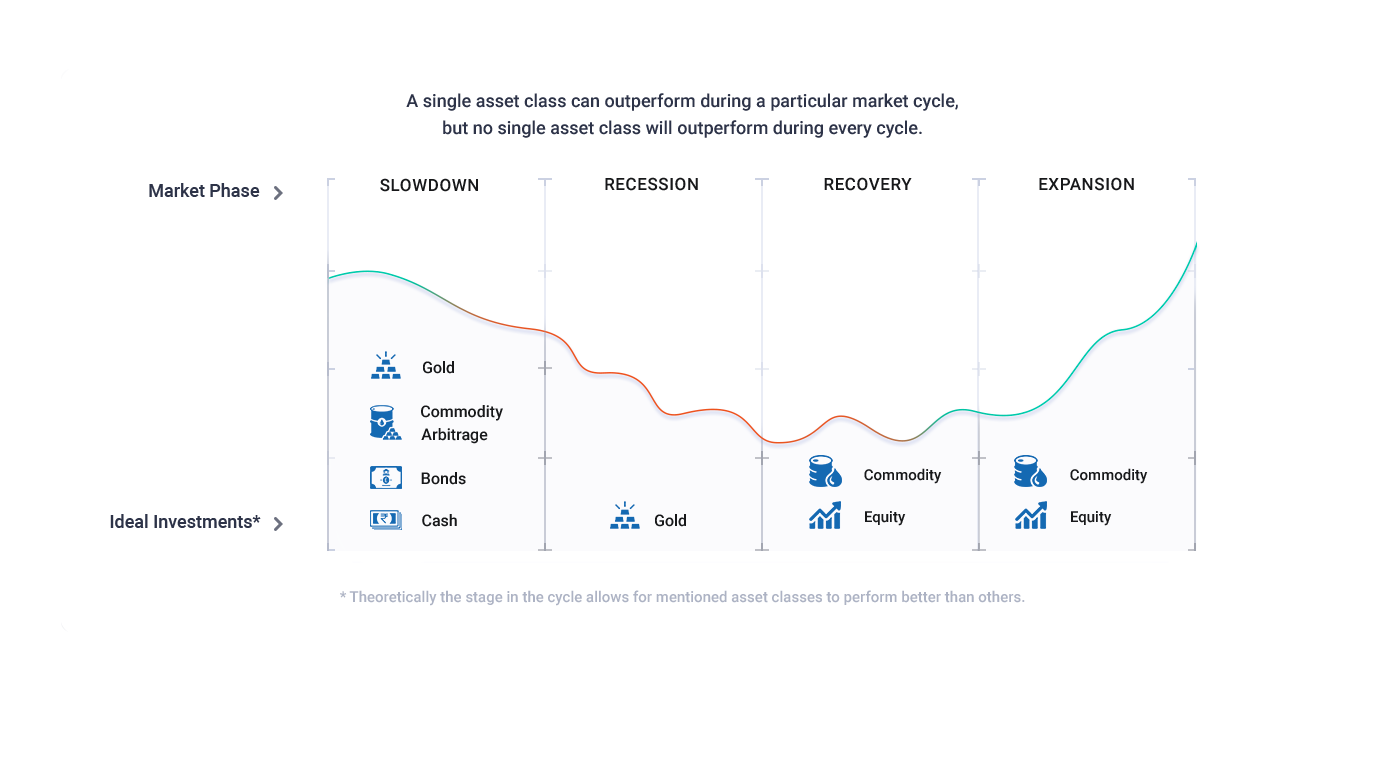

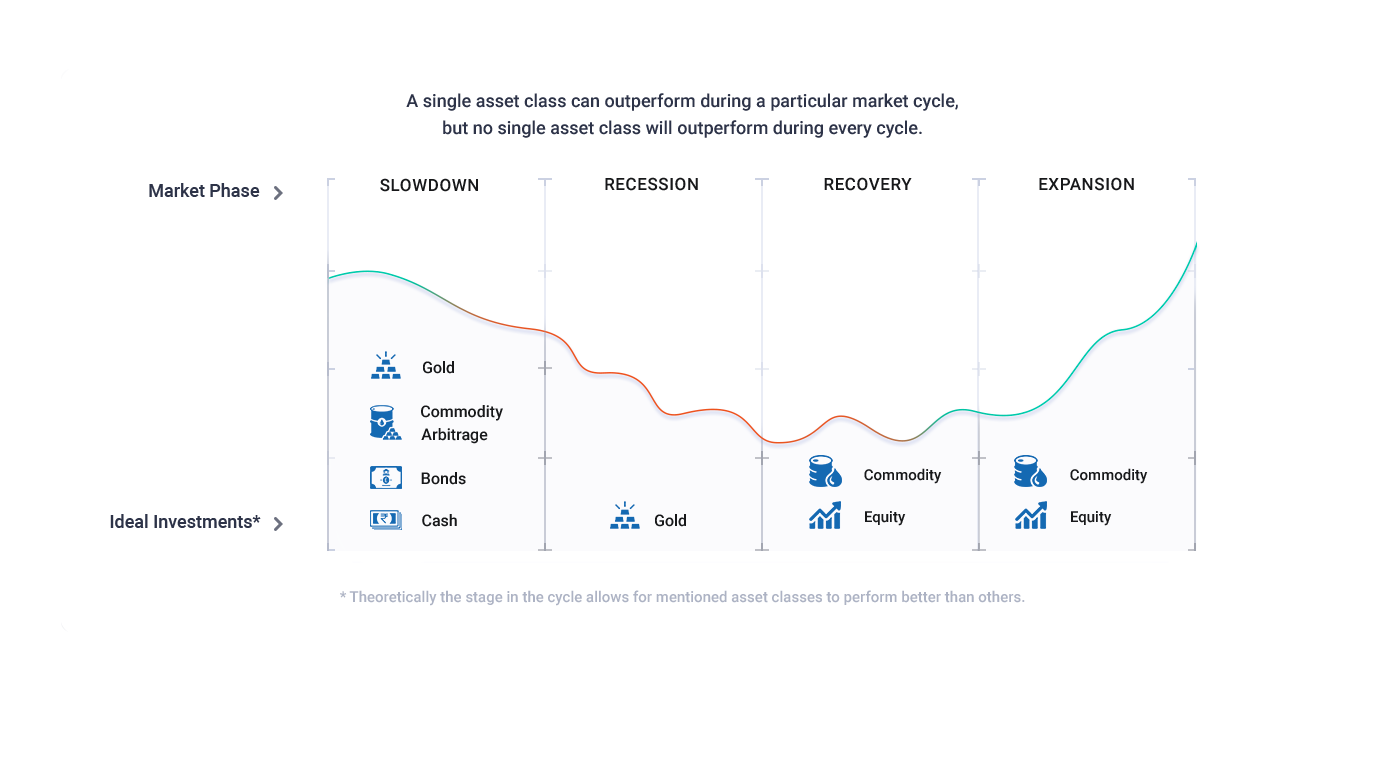

The Fund aims to generate returns across market phases through a combination of asset classes

The pioneer of commodity investing

through mutual funds in India.

The Fund aims to generate returns across market phases through a combination of asset classes

Those who want to diversify their investment portfolio with commodity exposure

Investors with long term investment horizon

Investors with an aim of seeking long term wealth creation across different market phases

| Scheme Name | TATA MULTI ASSET OPPORTUNITIES FUND |

| Investment Objective | The investment objective of the scheme is to generate longterm capital appreciation. However, there is no assurance or guarantee that the investment objective of the Scheme will be achieved. The scheme does not assure or guarantee any returns. |

| Type of scheme | An Open Ended Scheme investing in equity, debt and exchange traded commodity derivatives. |

| Fund Manager | Rahul Singh, Murthy Nagarajan, Aurobinda Prasad Gayan & Sailesh Jain |

| Benchmark | Composite Benchmark of 65% S&P BSE 200 + 15% CRISIL Short Term Bond Fund Index + 20% iCOMDEX Composite Index (Total Return variant of the index (TRI) will be used for performance comparison). |

| Min. Investment Amount | Amount Rs. 5,000/- and in multiple of Re.1/- thereafter |

| Load Structure |

|

Tata Multi Asset Opportunities Fund is suitable for investors who are seeking*:

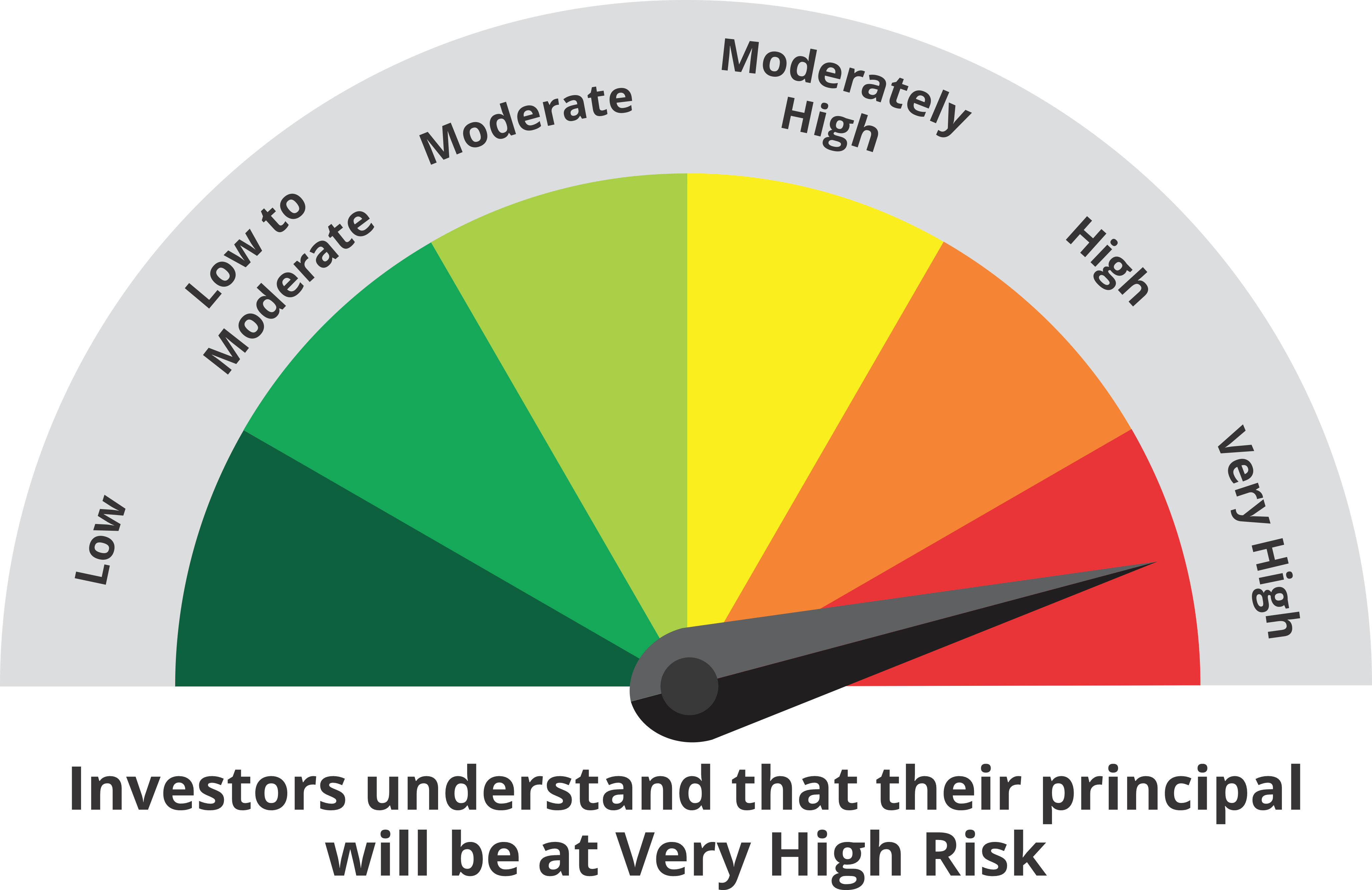

Investors should consult their financial advisors if in doubt about Whether the product is suitable for them.

Corporate Office Address:

Tata Asset Management Private Limited, 19th floor, Parinee Crescenzo, ‘G’ Block, Bandra Kurla Complex, Opposite MCA Club, Bandra (E), Mumbai – 400051